Benefits of a sale-leaseback

Is a sale-leaseback right for your business?

You must own your real estate in order to sell it.

Sale-leasebacks work best for mission-critical facilities.

Most sale-leasebacks involve long-term leases of 10 or more years. If the property is strategically important to your business, you're likely a strong fit.

We work with public, private, sponsor-backed and sub-investment grade companies alike. You don't need to an investment-grade rating to pursue a sale-leaseback. What matters is having a solid financial track record or strong market position, so investors can evaluate your ability to support rent payments over a long-term lease.

Sale-leasebacks allow companies to unlock capital from otherwise illiquid assets and redeploy into higher-return opportunities.

Recent investments

Novus Foods

W. P. Carey completed the sale-leaseback of a 66,000-square-foot food processing facility in Ohio. The transaction also included a commitment to fund an expansion to the existing facility and a build...

International Food Production Business

$104 million sale-leaseback of six mission-critical food production facilities located across the U.K., Czech Republic and Slovakia.

Plastic Container Manufacturer

$67 million sale-leaseback of three manufacturing facilities in North America.Explore more resources

The Ins and Outs of Sale-leasebacks

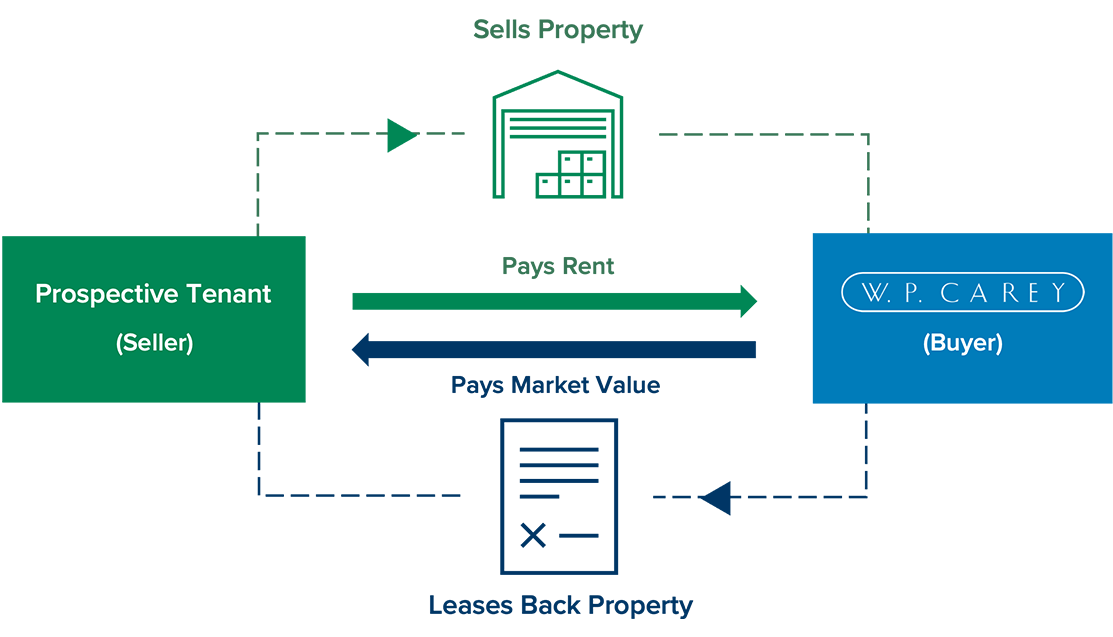

What Is a Sale-Leaseback? In a sale-leaseback (or sale and leaseback), a company sells its commercial real estate to an investor for cash and simultaneously enters into a long-term lease with the new...

Is a Sale-leaseback Right for Your Business?

Economic uncertainty and restricted debt markets are leading more corporate occupiers to explore alternative financing options such as sale-leasebacks to secure funds. In a sale-leaseback, a company...