Benefits of a sale-leaseback

Is a sale-leaseback right for your business?

You must own your real estate in order to sell it.

Sale-leasebacks work best for mission-critical facilities.

Most sale-leasebacks involve long-term leases of 10 or more years. If the property is strategically important to your business, you're likely a strong fit.

We work with public, private, sponsor-backed and sub-investment grade companies alike. You don't need to an investment-grade rating to pursue a sale-leaseback. What matters is having a solid financial track record or strong market position, so investors can evaluate your ability to support rent payments over a long-term lease.

Sale-leasebacks allow companies to unlock capital from otherwise illiquid assets and redeploy into higher-return opportunities.

Recent investments

RKW

Sale-leaseback of a manufacturing facility triple-net leased to one of Germany’s leading manufacturers of plastic films. In line with W. P. Carey's commitment to sustainability, this facility leverages 100% renewable energy.

Novus Foods

W. P. Carey completed the sale-leaseback of a 66,000-square-foot food processing facility in Ohio. The transaction also included a commitment to fund an expansion to the existing facility and a build-to-suit commitment for a new, Class-A distribution facility located on the same campus. Construction is expected to be completed in November 2026. The facility is triple-net leased to Novus Foods, a leader in the refrigerated food and snacks market. With an acquisition-based growth strategy, Novus has acquired and integrated market-leading brands that produce foods that are well positioned in their respective product categories. Novus Foods is backed by private equity firm CapVest and benefits from its significant investment in the company as well as the broader food market.

International Food Production Business

$104 million sale-leaseback of six mission-critical food production facilities located across the U.K., Czech Republic and Slovakia.

Explore more resources

The Ins and Outs of Sale-leasebacks

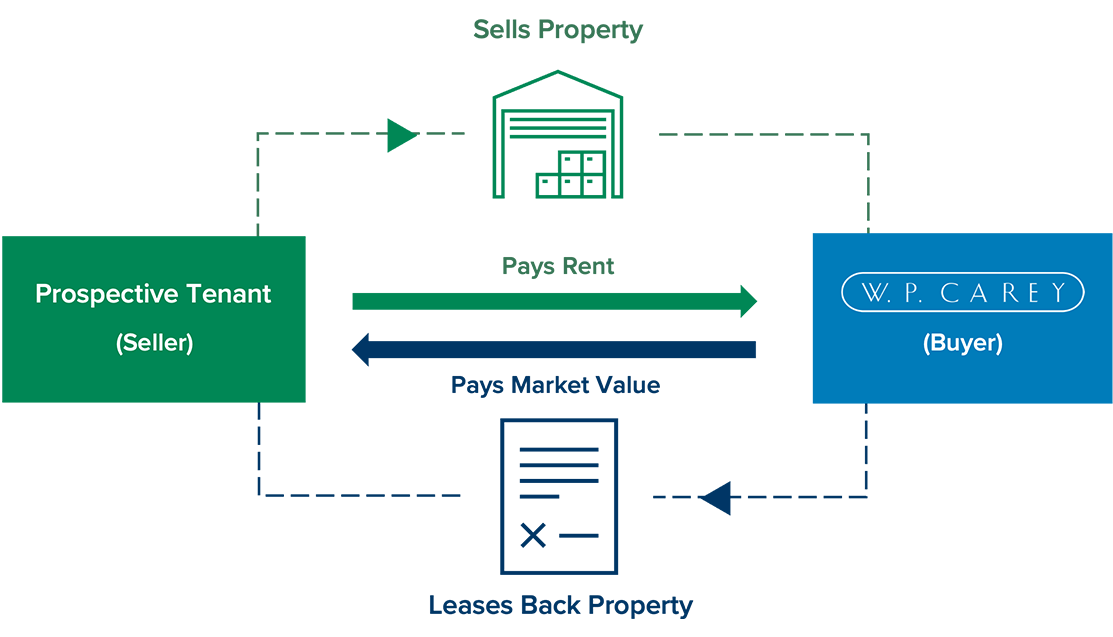

What Is a Sale-Leaseback? In a sale-leaseback (or sale and leaseback), a company sells its commercial real estate to an investor for cash and simultaneously enters into a long-term lease with the new property owner. In doing so, the company extracts 100% of the property's value and converts an otherwise illiquid asset into working capital, while maintaining full operational control of the facility. This is a great capital tool for companies not in the business of owning real estate, as their real estate assets represent a significant cash value that could be redeployed into higher-earning segments of their business to support growth. What Are the Benefits? Sale-leasebacks are an attractive capital raising tool for many companies and offer an alternative to traditional bank financing. Whether a company is looking to invest in R&D, expand into a new market, fund an M&A transaction, or simply de-lever, sale-leasebacks serve as a strategic capital allocation tool to fund both internal and external growth in all market conditions. Key Benefits Include: Immediate access to capital to reinvest in core business operations and growth initiatives with higher equity returns. 100% market value realization of otherwise illiquid assets compared to debt alternatives. Alternative capital source when conventional financing is unavailable or limited. Ability to retain operational control of real estate with no disruption to day-to-day operations. Potential to gain a long-term partner with the capital to fund future expansions, building renovations, energy retrofits and more. Who Qualifies for a Sale-Leaseback? There are several factors that determine whether a sale-leaseback is the right fit for a company. To be eligible, companies must meet the following criteria: Own Their Real Estate The first and most obvious criterion for qualification is that the company owns its real estate or have an option to purchase any existing leased space. Manufacturing facilities, corporate headquarters, retail locations, and other forms of real estate can be potential candidates for a sale-leaseback. Unlocking the value of these locations and redeploying that capital into higher yielding parts of the business is a key driver for companies pursuing sale-leasebacks. Be Willing to Commit to Operating in the Space While the term of the lease in a sale-leaseback can vary, most investors will want a commitment from a future tenant to occupy the space for a 10+ year term. Assets critical to a company’s operations are often good candidates for a sale-leaseback because a company is willing to sign a long-term lease for those locations. This makes it a more attractive investment for sale-leaseback investors as they have more security that the tenant will stay in the facility for the long term. Have a Strong Credit Profile Companies do not need to be investment-grade quality to pursue a sale-leaseback. However, some credit history is typically required so the sale-leaseback investor knows that the business can make rental payments over the course of the lease. Sub-investment-grade businesses are still eligible as long as they have a strong track record of revenue and cashflow from which to judge their creditworthiness; however, they may need to find an investor who has the underwriting capabilities to assess their business. Minimum revenue and profitability requirements will vary based firm to firm, so it’s best to ask about this upfront before engaging with any particular sale-leaseback partner. Qualities to Look for in a Sale-leaseback Investor When considering a sale-leaseback, finding the right buyer is critical in order to ensure a company is maximizing the value of their real estate. Here are some of the key qualities to look for in a sale-leaseback investor. Experience A knowledgeable investor can offer more flexibility and guide sellers through the process, creating customized deal structures to meet all of a company’s unique objectives and avoid potential pitfalls. Additionally, experienced investors can typically navigate all market cycles and offer certainty of close (some in as little as 30 days), ensuring the deal closes in a timeframe that works for the company and their fiscal requirements. An All-Equity Buyer When looking for a sale-leaseback partner, finding an all-equity buyer is important, particularly when dealing with timing constraints. All-equity buyers don't have to worry about third-party debt or financing contingencies, meaning there’s less likelihood of a re-trade in the late stages of negotiation. All-equity buyers can also typically close faster as they do not need to wait on approval from banks or lenders, providing a smoother process overall. A Long-Term Real Estate Holder Finding a long-term investor is vital. Sellers don’t want someone who is simply looking to flip a property for a quick profit. Instead, look for an investor who will remain a committed partner to you over the long run and one that can provide capital for future projects such as expansions, renovations, or energy retrofits. Diverse Knowledge and Experience Different industries, property types and locations require unique expertise to efficiently and effectively partner with sellers to structure a deal that address the needs of all parties. Working with an investor with experience in the company’s specific industry, property type and/or country ensures that all potential risks and opportunities are considered before entering into a sale-leaseback agreement. For example, if you are considering a cross-border, multi-country transaction it’s critical you look for an investor with local teams in those countries who speak the language and understand the local rules. What is a Build-to-Suit? When looking into a sale-leaseback, another term companies may encounter is a build-to-suit. In a build-to-suit, a company funds and manages the construction of a new facility or expansion of an existing one to meet the specifications of a prospective or existing tenant. Upon completion, the company enters into a long-term lease, similar to a sale-leaseback. For companies looking for a brand-new property, this is a great solution that requires no upfront capital. The Main Benefits of Build-to-Suits Include: Development of a custom-built facility in a location of the company’s choice. No upfront capital required, enabling the company to preserve capital for its business. Ability to retain operational control of the facility post construction. Potential to gain a long-term partner with the capital to fund future expansions, building renovations, energy retrofits and more. Conclusion While sale-leasebacks may seem intimidating for companies who have never pursued one, working with an experienced and well-capitalized investor can make the process easy. When working with an investor like W. P. Carey, sellers can ensure they are working with a partner that can understand the unique requirements of their business while having the added option of closing in as little as 30 days and the added advantage of gaining a long-term partner who can support its tenants through flexibility and additional capital should they wish to pursue follow-on projects such as expansions or energy retrofits as their business and real estate needs evolve. In all market conditions, sale-leasebacks are a great financing tool to unlock otherwise illiquid capital that can be reinvested into a company’s business to support future growth. Think a sale-leaseback is right for your company? Contact our team today!

Is a Sale-leaseback Right for Your Business?

Economic uncertainty and restricted debt markets are leading more corporate occupiers to explore alternative financing options such as sale-leasebacks to secure funds. In a sale-leaseback, a company sells its real estate to an investor for cash and simultaneously enters into a long-term lease thereby unlocking otherwise illiquid capital to redeploy into higher growth segments of its core business. A sale-leaseback is an innovative tool that can be especially advantageous in today’s market where debt financing may be less attractive but is your company and your real estate the right fit? Read on to determine if (and when) a sale-leaseback is right for your business. The Criteria for a Sale-leaseback Own your real estate The key criterion for a sale-leaseback is real estate ownership. One of the primary drivers for a company to undertake a sale-leaseback is to unlock 100% of the real estate’s value while maintaining long-term operational control of the asset. By selling your property and leasing it back, you remove a non-incoming producing, fixed asset (real estate) and unlock liquid capital to reinvest into your business. Own the right type of real estate While the mainstream commercial property sectors of industrial, retail and office are most common in a sale-leaseback transaction, other specialty assets like life sciences and data centers have expanded the pool of investable assets. Make sure it's critical to your operations Investors look for specific value-add characteristics before buying a property. For instance, it’s best if your asset is mission-critical—in other words, an essential revenue driver for your business. Potential investors will also likely consider the property’s condition and age (high-quality, modern assets with sustainable features will be more valuable), location (think proximity to transportation routes) and size. Desired size will depend on the investor and often vary by property type. Retail properties for example tend to be smaller (perhaps around 20,000 square feet), compared to an industrial asset that might be upwards of 250,000 square feet. Additional space to expand the facility is also a plus for investors. However, the criticality of the asset to your operations is often more important than the asset type or size itself. Have a strong underlying credit story (sub-IG credits welcome!) You’ll attract real estate investors if you have a strong underlying credit and revenue history. Due to the long length of leases typically associated with sale-leasebacks, the investor will want to be confident that you can consistently pay rent throughout the lease term. However, this doesn’t mean your company must be investment grade. Many investors can work with sellers that are sub-investment grade so long as the underlying fundamentals of the business are solid. Institutional investors with strong underwriting capabilities will be able to evaluate all credits and assess your financial statements in order to get comfortable with pursuing a sale-leaseback deal. Be willing to sign a long-term lease, but ask the right questions upfront The last criterion for a sale-leaseback is that you must be willing to sign a long-term lease with the investor, typically 10-30 years. Before signing a long-term lease, it’s important to consider some critical factors, including: Space requirements: Evaluate your current and future space requirements to ensure the leased property will accommodate your needs for the duration of the lease. If additional space is needed, it’s possible your sale-leaseback partner will work with you on an expansion or build-to-suit of a brand-new asset. Renewal options: Does the lease come with renewal options? Find out the renewal terms for which the lessor is willing to extend the lease period so that you can continue occupying the property once the initial period for the lease expires. Maintenance and repairs: Know who's responsible for any maintenance and repair needs of the leased commercial property. In a triple-net lease, for instance, the tenant is responsible for all insurance, taxes and maintenance expenses, which also means the tenant maintains full operational control. By considering all the above factors, you can make an informed decision and confidently enter into a long-term lease. When to Consider a Sale-leaseback? While sale-leaseback financing is an excellent alternative to loans and other debt financing, it's not ideal for every company in every circumstance. Here are a few examples of when it makes sense to consider a sale-leaseback for your business. When you need capital for growth Sale-leasebacks are an excellent tool to unlock cash for growth initiatives, particularly for companies with limited access to traditional forms of financing. Proceeds from sale-leasebacks can be channeled to investments in new equipment, technology, personnel or additional facilities. And the best part is that a sale-leaseback enables you to raise capital without losing control of your property. To support M&A If you're considering an M&A transaction, you may need to raise additional capital to fund the purchase of the target company—or to pay down debt following an acquisition—which may be the case for companies and private equity firms alike. Usually, the cost of capital for commercial real estate investors is quite competitive as a real estate investor will acquire your property at market rate, creating an immediate arbitrage between the real estate multiple and the acquired business EBITDA multiple. To strengthen your balance sheet A sale-leaseback can help strengthen your business’ balance sheet by shoring up much-needed cash. You can use the raised capital to pay off existing debt, boost your debt-to-equity ratio or invest in other revenue-driving areas of your business. Remember the composition of your business’ balance sheet determines how lenders, investors and shareholders view your company's risk profile. If you have less debt, your business will be more attractive to these parties. Final thoughts A sale-leaseback transaction is an excellent alternative for companies, especially during periods when traditional sources of financing are limited. When choosing a sale-leaseback partner, consider an experienced, long-term investor who can buy on an all-equity basis and who is willing to work with you throughout your lease (and beyond). W. P. Carey has been a leader in sale-leasebacks since 1973 and is well-positioned to continue helping companies unlock capital even in today’s challenging economic environment. Maximize your real estate and unlock immediate capital by contacting our team today!

What to Expect When Selling to W. P. Carey

W. P. Carey is a leading global real estate investment company, specializing in the acquisition of operationally critical, single-tenant properties in Europe and North America. With over 50 years of experience and a portfolio of over a thousand properties in 25 countries, W. P. Carey has an established track record of enabling companies to unlock the value of their real estate. We develop creative deal structures tailored to the unique needs of each seller and have the ability to structure complex, multi-asset, multi-jurisdictional deals. Whether you are interested in a sale-leaseback, build-to-suit or the sale of an existing net-leased property, we will work with you to understand your objectives and maximize the proceeds to reinvest in your business. We pride ourselves on a fast and efficient deal process, completed at a pace that meets the seller’s timing requirements. With the ability to close all equity and in as little as 30 days, W. P. Carey welcomes the opportunity to work with you. 1. Origination W. P. Carey works with the seller and its advisors to shape the scope of the transaction. During this initial phase, W. P. Carey seeks to understand your business needs and real estate portfolio and offers suggestions on the optimal structure based on your unique situation and goals. 2. Offer Using the insights gathered during the origination process, W. P. Carey presents a custom letter of intent outlining the key framework of the proposed transaction. We work together to refine the terms until both parties are in agreement. 3. Approval Following signature of the letter of intent, W. P. Carey presents the transaction to its investment committee and completes its underwriting process. The preparation and negotiation of the transaction documents takes place seamlessly in parallel. 4. Closing All documents are signed and funds are transferred to the seller. As an all-equity buyer, W. P. Carey does not need to obtain mortgage financing to fund its acquisition, providing fast execution and high closing certainty. Interested in selling your real estate to W. P. Carey? Contact us