Case Study Library

W. P. Carey has 50+ years of experience helping companies monetize their real estate. Explore our growing library of case studies to discover why industry-leading companies choose W. P. Carey to unlock the value of their real estate.

Featured Case Studies

Leading producer of flexible packaging

W. P. Carey completes $20 million sale-leaseback of manufacturing facility in Chattanooga.

Morato

W. P. Carey completes $70 million sale-leaseback of food production portfolio in Italy and Spain.

Linde + Wiemann

$42 million sale-leaseback of four industrial facilities in Germany and Spain.View More

Displaying 1 - 7 of 7

Metra

$86 million follow-on sale-leaseback of with existing tenant backed by strong private equity sponsorship.

Upfield

$25 million in build-to-suit financing for portfolio company's state-of-the-art, BREEAM Outstanding R&D facility.

Turkey Hill

$84 million in sale-leaseback capital provided to PE-sponsored ice cream and beverages brand.

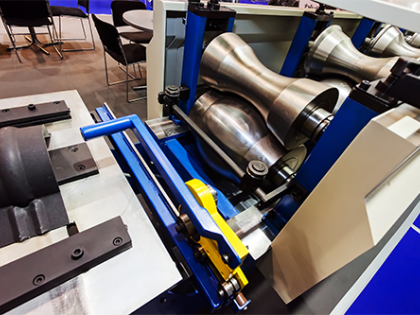

Siderforgerossi

$80 million in sale-leaseback capital provided to PE firm to help pay down debt and reinvest in portfolio company growth.

CentroMotion

$45 million of sale-leaseback financing provided to PE firm to help pay down debt and expand portfolio company facilities.

ABC Group Inc.

$239 million of capital secured through two sale-leaseback transactions with a global automotive supplier.